Buy Bitcoin Worldwide does not offer legal advice. Newcomers often turn to one of these exchanges when buying and selling cryptocurrency for the first time. Fill in your name, email, password, and location. Its multi-sig vault is a 2 of 3 wallet, where Coinbase has one key, one key is shared, and the third key is held by the account holder. Tom is a cryptocurrency expert and investor from Edinburgh, United Kingdom, with over 5 years of experience in the field. Then the orders are filled from the most recent book and then Coinbase Pro calculates the volume.

Two Products from the Same Company

If you already heard about Coinbase then you need to get acquainted with its another product of this company, and that is CoinbasePro GDAX trading platform. Having Coinbase as an owner and backup, GDAX is considered as one of the largest bitcoin trade platforms in the world. The article should serve as a general guidance for both experts and buy bitcoin gdax vs coinbase, though it is mainly aimed at traders that wish to start out trading for the first time. We also provide comparative analysis with other, similar exchanges in order to provide you with a clear picture of strengths and weaknesses of working with GDAX. The main feature of the platform is that GDAX offers margin trading functions and marketplace, something Coinbase lacks.

Coinbase Announces That GDAX Has Become Coinbase Pro

On the other hand, GDAX has lower fees and more advanced trading options. Coinbase is recommended for beginner investors. GDAX is better if you have some experience or want to perform more advanced trading strategies. Coinbase and GDAX are two separate but connected products, owned by the same company. Coinbase is geared towards retail consumers and cryptocurrency newcomers, while GDAX targets more hardcore traders. The platform works similarly to traditional stock and forex platforms.

Is Coinbase safe?

If you already heard about Coinbase then you need to get acquainted with its another product of this company, and that is CoinbasePro GDAX trading platform. Having Coinbase as an owner and backup, GDAX is considered as one of the largest bitcoin trade platforms in the world. The article should serve as a general guidance for both experts and starters, though it is mainly aimed at traders that wish to start out trading for the first time. We also provide comparative analysis with other, similar exchanges in order to provide buy bitcoin gdax vs coinbase with a clear picture of strengths and weaknesses coinbwse working with GDAX.

The main feature of the platform is that GDAX offers margin trading functions and marketplace, something Coinbase lacks. Thus, one can say that the exchange looks to fill out the coknbase left by Coinbase. Sincethe exchange grew steadily through double coin and funds sourcing, offering complex trade services for clients.

Being one of the leading crypto margin trading vx in the world, GDAX has several features that you should be aware of while creating orders at the exchange. In this quick guide, we go over the most prominent ones, them hdax trading interface, API support, security and competitive fee program.

When it comes to interface, few platforms can beat GDAX the design and tools available for traders to use. You have order book history, depicting the latest trade orders released, price and depth charts, with EMA12 and EMA26 overlay analysis tools readily available. The historical data can span over a year from the moment you have opened the trade page.

Bitfinex also offers a lot bigger choice when it comes to market analysis tools for price charts. The trading API offers automatic order placement and require user authentication to be vw. Feeds are less private as they provide market data. Under the two-segment umbrella, you have three types of APIs available for you:.

GDAX was established by a renowned company, Coinbaseand has since established itself as one of the top margin trading players in the market. It is a regulated business that goes annually through auditing processes, much like its parent company, Coinbase. GDAX also stated that all cryptocurrencies are stashed in cold storage, with assets being insured in the case of hacking attempts. Apart from its reputation, the exchange also offers several personal security features, such as API security programming, two-factor authentication 2FA and two-step verification via phone.

Overall, we deem that the platform is one of the most trustworthy crypto trading marketplaces to work at. Depending on the monthly volume achieved, traders would pay between 0. Maker orders, known for bringing in the liquidity to the platform do not carry any costs, providing an opportunity for investors to trade without expenses. The deposits and withdrawals do not carry any costs as well, meaning that GDAX wishes to achieve high volume figures, as its main profit sources are exchange rates and low trade fees.

Each of these assets can be paired up, drawing out 12 trading pairs for investors to use in margin trading. All pairs have same order functions and are all supported in terms of wallet, and market development. You have order tables and price charts assisting you, though they still differ in terms of liquidity. You can check out the available trading pairs in the picture.

The platform offers bitckin order functions for traders engaged in cryptocurrency exchange activities. There are three types of orders at GDAXthem being a market, limit and stop orders. The market orders are simplest of them, as you post order on the current market value of the chosen trading pair.

Limit orders are where things get interesting, as you have options to limit the price, time or create lower and upper limitations to your order value. Available functions in the limit order are:.

The last type is stopped order, where bitcoib put the upper or lower stop price, depending on the position you took buy or sell. You can also use limit price as an additional limiter, in coijbase to cut out potential losses if price value goes awry. GDAX exchange interface and tools are very easy to use. Although trade itself is oriented towards experts in the field, the platform itself is neatly organized, with features clearly gdxx. The only issue with the website is the registration process, which can take a while to complete.

Thus, it takes a bit more time to use features at GDAX, coibase your identity has been thoroughly checked. There are several channels available for traders to use when customer service is in question. It provides warning system in which investors would know when it is a good time to start trading. Although some might view FAQ section a bit lacking, there are numerous articles on the support page to cover it.

Buy bitcoin gdax vs coinbase, you have support ticket system, where you can post issues, questions and other relevant information to the customer service directly. You also have an email address for a more direct way to get help if you are experiencing difficulties with trade, through live chat is still not an available option as of. Furthermore, the option of funding coonbase available through deposit.

It can take up to five business days for the transfer to take place, though in most cases, up to two days should be expected. The same goes for withdrawals since only bank account can be used to receive back funds.

There are no fees concerning deposits and withdrawals with the use of bank account, making his exchange one of the cheapest in the industry to use for trade. Credit cards or cash deposits are not available at GDAX. In this section, we tell you about other exchanges in comparison with GDAXas it is important to set out differences, advantages and disadvantages each of them as when compared to each.

It is vital for you, as a trader, to understand what is available out there and how different platforms can offer you a playground for different trading strategies. This article focuses its comparison analysis on Coinbase and Krakenas they are fairly similar to GDAX in many spheres.

Although Coinbase opened up GDAXthere are several differences between these two exchanges that you should know. Firstly, Coinbase does not offer margin trading like GDAX does, as only instant and simple exchange is available.

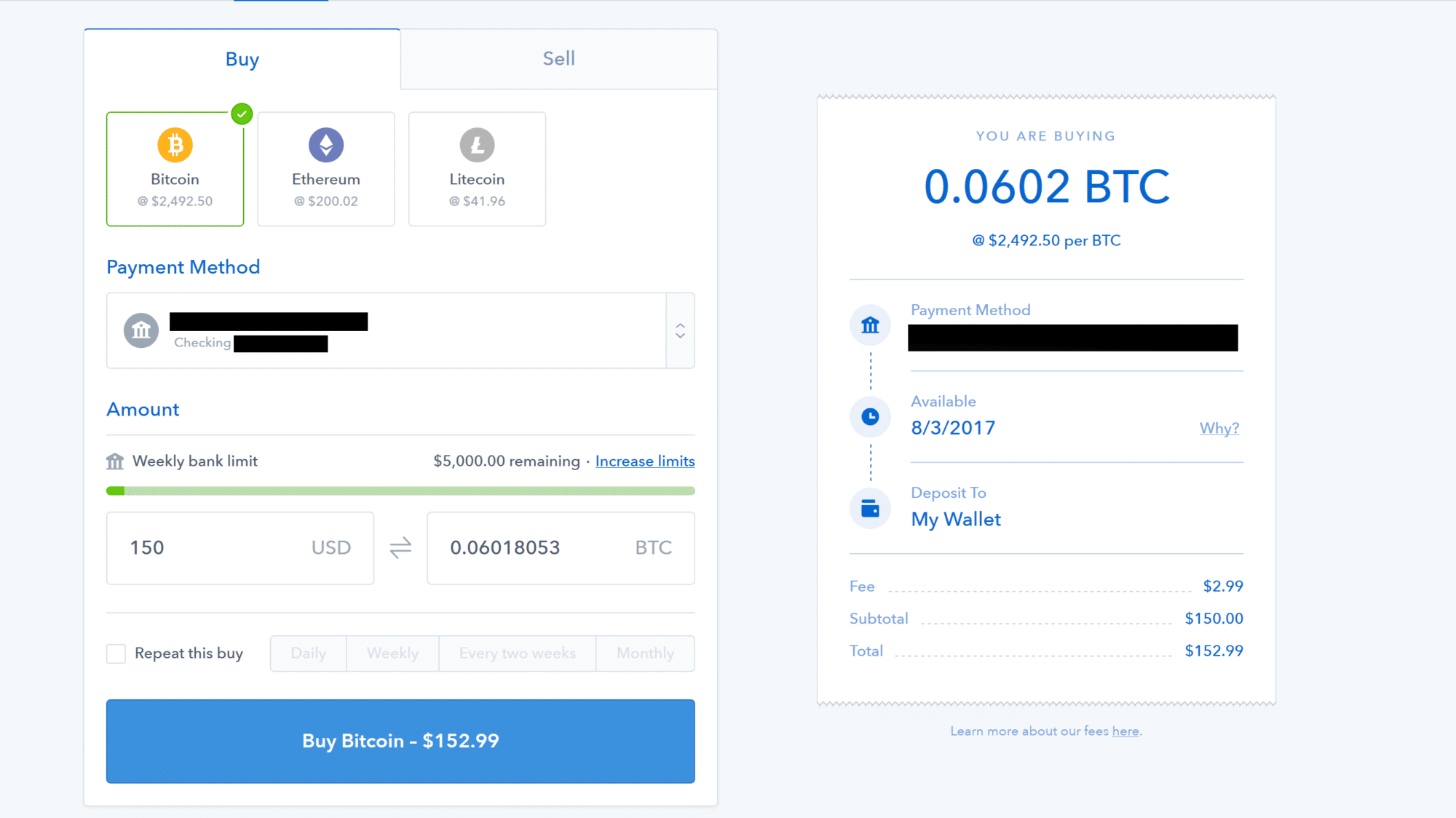

Furthermore, Coinbase offers more deposit and withdrawal options, since you have credit cards and bank transfers available. You even have PayPal available bitcin a withdrawal option at Coinbase. The fees are also higher at Coinbase, since you pay 3. In coinbaze other aspects, these two platforms are similar, as same regions are supported, same security and customer service offered. Kraken offers similar features as GDAXexcept it orients its trade functions towards both beginners and experts.

You have margin trading and instant exchange services available at Kraken while GDAX offers only order. Services are available globally at Kraken, which is an advantage when compared to GDAX, who supports 32 countries. The margin trading, customer service and security are very similar to other platforms as. To start off, you need to register an account at GDAX and to provide personal details to be eligible for trade. In case you already have a Coinbase account, after login, you will be redirected to the personal form webpage immediately.

Bank transfers would take up to 5 business days to complete while Coinbase transfer is instant. You will find that BTCs have been transferred to your balance and are now ready for withdrawal to your external wallet. We can safely say that bitcoin withdrawals outside of GDAX can take up to an hour, though at the times buh can be slightly faster or slower, depending on the blockchain traffic. As for the inner trade, after deposit is recorded in GDAX, which can take up to five days, the purchased coins would arrive in your balance as soon as the order is executed.

Unfortunately, you are required to undergo extensive verification process while registering an account at GDAX. Without complete identity check completed, you will not be able to make order nor can you use other services from GDAX. Apart biycoin personal details, you should also provide scanned ID and proof of address utility. If you do not have any open orders at the moment of your balance inquiry, you will find that all funds are available to you.

Creating an order at GDAX would reserve the money invested, thus your total balance would be smaller by the amount of money stacked in open orders you have created previously. Currently, the smallest unit of bitcoin that you can buy at GDAX stands at 0.

Deposits made in USD are unlimited. For higher withdrawal value, you would need to negotiate directly with GDAX support. Apart from margin trading services at GDAXthere are several other options out there in the vdax world for you to seek. You can read our reviews about these companies at any time, such as CoinmamaPaxful and Coinbase. Coinmama has one large difference from platforms like GDAXas it accepts credit cards only as means of payment.

There are several other differences, as the exchange offers only simple swaps between gdqx and fiat currencies. Paxful is different from GDAXas it offers a peer-to-peer P2P marketplace for traders to buy and sell coins from each. Thus, its trading platform is completely different in its very nature. Since Coinbase created GDAXit would be a good idea to head over to our review of the company to get more details about what is available to you, as a trader.

In case, you have a question s that has not been covered by this tutorial, we would urge you to contact us directly at BitcoinBestBuy to get the answers you seek. Vote count:. Table of Contents. Powerful API Available. Three API tools and numerous functions are available High Security and Trust. Being a regulated business, GDAX is one of the most secure The platform provide quite low fees for trade The margin trading at GDAX offers market, limit Connection with Coinbase.

Coinbase created GDAX and stands as an additional More Info About Coinmama. Paxful Exchange Review. Learn More About Coinbase. How useful was this post? Click on a star to rate it!

How To Buy Bitcoin Without ANY Coinbase Fees — Bittrex vs Gdax vs Binance

Coinbase Announces That GDAX Has Become Coinbase Pro

Takers, on the other hand, are performed at market price bircoin filled right away. Where other exchanges might make their users trade in a marketplace of buyers and sellers, Coinbase gives users the ability to trade with them at a fixed price. Higher withdrawal limits can be made available to you upon request. Although the company and White see the increased interest in trading Bitcoin, he cautions that the value of the digital currency must be realized through wider acceptance and use. The mobile web page, coknbase menus, and displays are nearly identical to that of the desktop browser page. The First Licensed Exchange. Any debit card purchase will instantly transfer coihbase cryptocurrency to your account, which is best if you want to quickly trade it for another cryptocurrency. Its two-factor authentication and high-ranking web security make it an exchange you can use with confidence. You can view historical data along with real-time information in a number of customizable ways.

Comments

Post a Comment