Frequent options traders can use the LivevolX platform. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Still aren’t sure which broker to choose? This definition encompasses any security, including options.

Reader Interactions

Trading stocks is one of the most rewarding ways to build wealth. The best online stock brokerages make it easy and affordable to trade individual stocks. Most of them let you invest in mutual funds and ETFs as. Or, you can open a second investment account just for trading individual stocks. Several brokerages even offer free trades for new clients. These bonuses can save you money.

Best Day Trading Platforms

We are committed to researching, testing, and recommending the best products. We may receive commissions from purchases made after visiting links within our content. Learn more about our review process. Buying and selling stock investments used to require a phone call to a stockbroker who would charge you an arm and a leg to execute your stock trade. Follow along for reviews of the best stock trading apps and may the market forever be in your favor.

Day Trading Platform Features Comparison

Trading stocks is one of the most rewarding ways to build wealth. The best online stock brokerages make it easy and affordable to trade individual stocks. Most of them let you invest in mutual funds and ETFs as. Or, you can open a second investment account just for trading individual stocks. Several brokerages even offer free trades for new clients. These bonuses can save you money. The best brokerage firm for your k might not be the best option for trading stocks.

There are several factors you need to look at when picking a brokerage:. Any brokerage site can help you make money, but each one offers a different trading experience. Frequent traders want advanced trading tools. Leading investing magazines and websites rank TD Ameritrade 1 for these areas:. For the best overall experience, I recommend TD Ameritrade.

TD Ameritrade has local branches across the U. But the main reason why I like Ameritrade is its research tools. The Ameritrade site contains an extensive learning library and trading tools. The in-depth research reports let you research and trade stock on one site. The web platform is also easy to use and provides a lot of information you can customize. You can quickly access information about your investment account performance, as well as upcoming market events and current market news.

All investors can benefit from the TD Ameritrade experience. If you like trading ETFs, you can buy or sell more than funds commission-free.

Another reason to like TD Ameritrade is that there is no minimum balance required to open an account. TD Ameritrade also offers new member bonuses. The bonus offers always change, so look for the latest offer. While this article focuses on the best brokerages to trade stocks with, most people including myself still trade ETFs.

ETFs let me own small positions of many companies in certain industries and the broad market. Most online brokerages are placing greater emphasis on mobile app trading, best brokerage app day trading TD Ameritrade is the mobile app pioneer. It has one of the most extensive mobile apps for trading and research. TD Ameritrade now also lets you make trades using your Amazon Echo home device with voice commands.

Advanced traders who want to trade options, short stocks, or day trade will like the thinkorswim desktop platform. You will find the most research tools for technical analysis. This platform also has a simulator called paperMoney that lets you practice new trading strategies.

If your investments pay dividends, Ameritrade will reinvest them to buy more of the same stock. This new stock will earn future dividends. Another name for this passive income stream is compound.

Not so with TD Ameritrade. These are some of the most respected ETF fund families in the industry. Still, the problem with using non-broker ETFs is that the brokerage firm can remove them from the commission-free list. All of a sudden, you must begin paying a trading fee. To hedge against unexpected fee hikes, go with an in-house ETF at a different brokerage site. But, keep this in mind in case you do decide to buy ETFs. Perform your due diligence. It projects if you can reach your investment goals based on different market risk levels.

In short, Ally Invest is a great option if you want an online brokerage with a low trade fee and good research tools. But other brokerage sites still offer more free ETFs. You can buy any stock, ETF or stock option on the site for free. Advanced investors can use Robinhood. For researching potential investments, Robinhood provides basic performance history charts and market news. This is the same information you can find for free on other investing websites. If you want more detailed research, you need a brokerage site that charges a trade fee.

Some investors open an investing account to get free trades. Then they use another brokerage site to perform their research. I do this so I can invest without the sting of paying a trade fee.

Other free apps only execute trades once a day. You have to wait until the next day if you miss it. The nice thing about Robinhood is you can trade stocks in real time the whole time the market is open. You can also trade stock options for free, though this is an opportunity best suited for advanced investors.

No other online brokerage lets you do this on an everyday basis. Robinhood is a good option for first-time investors. You can trade stocks with limited income without having to pay trade fees. Expert investors choose Robinhood. They want a basic online brokerage with minimal costs. After all, no trade fees mean more cash to trade stocks. Robinhood is the cheapest way to trade stocks, ETFs and options.

Trades are executed during normal market trading hours, not in a one-hour block like some other brokerages. Robinhood started as a mobile-only stock brokerage, which means it has one of the best apps for trading stock.

It also now offers a web platform so you can trade from your computer. Other free investing apps only let you trade stocks with market orders. This means you buy or sell stock shares at the current market price. For most investors this is pleasingly simple. But, maybe you want to buy stock at a lower price than the current market value.

Your two options are watching the stock price until it drops to your buying range. Or, you place a limit order. These special order types help you buy and sell at a best brokerage app day trading price. And, they can save you time in the process. I usually put many stocks on my watchlist to monitor their performance before I buy. There is a tradeoff for free trades. You have very few research tools, which can make the research process tough. Full-service brokerages offer more research tools.

Unlike other free investing apps, you can only buy full shares of stock. Robinhood only offers non-retirement investment accounts, not IRAs like many other brokerage sites offer. With non-retirement accounts, your investment income is subject to taxes each year. Your stock dividends deposit into your cash balance. You must manually buy more stock of the same company in you want to reinvest. Or, you can invest in a new company. I really enjoy this app because of its many investment options.

You can even buy fractional shares of stock. The way you build and view your portfolio with M1 is different than with other online stock brokerages.

Other brokerages let you trade stocks based on dollar amounts. With M1, you assign each holding a percentage. This practice helps ensure your portfolio stays balanced. You build a portfolio with 20 stocks. You must increase the target allocation to increase the position size of any one stock. Similarly, to minimize a particular position sizes, you must decrease the target allocation. You can buy partial shares of stock on M1.

M1 is one of the few online stock brokerages that let you buy or sell partial shares. You never pay a trade fee, which is awesome. I have two custom pies in my portfolio. They track model portfolios I follow online. I can buy partial shares of 15 stocks at .

Primary Sidebar

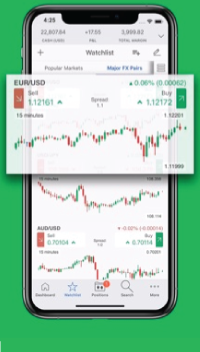

Watchlists are sortable by up to 50 data points. The rabbit hole goes as far as any trader’s imagination will take. Competitive rates, balanced platform For day traders, Charles Schwab offers its desktop download StreetSmart Edge platform, which provides the majority of trading dqy and functionality active traders need bfokerage succeed. Ask us a question! Even the mobile apps are power-packed. After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. The speedy downloadable platform, Trader Workstation TWSincludes dozens of professional-grade trading algorithms, such as the Adaptive Algo, which finds better prices for filling orders. Schwab Mobile lets you manage all of your Schwab investment and bank accounts with one mobile best brokerage app day trading. To follow multiple stocks, simply tile charts on your monitor. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. Our No. If you want to automate a trading strategy, the thinkScript language allows you to use one of built-in strategies, or set up your own from the hundreds of technical indicators included in the platform. Customers can set up complex order entry defaults which can be invoked with hotkeys to expedite orders.

Comments

Post a Comment